Trading Activities

Strategy

The Group’s growth strategy is focused on sustainable energy commodities and projects, implemented through geographical expansion in new markets, product diversification, and acquisitions.

Geographical Expansion

While we are determined to maintain a leading position in the key markets where we historically trade, our goal is to fuel further growth through geographical diversification in new markets for both Crude Oil and petroleum products. We have grown our offices in Houston and Belgium by hiring traders and business developers specialised in Crude Oil and petroleum products. We have also reached new areas in France and started deliveries into Germany.

Our trading activities have expanded to the US West coast domestic and export business; in addition, we gained foothold in Central and South America.

We continue to develop trading activities between countries in South East Asia.

We have further expanded our trading flows into and from selected African countries such as Rwanda, Nigeria, Zambia, Congo and South Sudan.

Product Diversification

From our historical portfolio of Crude Oil and petroleum products, we are now covering all major components of the barrel and have been trading LPG and LNG in the last few years, in addition to niche products.

We have increased our portfolio of Crude Oil by trading new grades in new geographical regions. We have also expanded our presence in Ultra Low Sulphur Diesel (ULSD) with long-term agreements in the Eastern and Western hemisphere. We started trading LPG in 2015 by securing a term contract on the back of an investment in an import terminal in Bangladesh with an annual throughput capacity of 150,000 mt and have been gradually expanding our portfolio of trading flows.

In 2016, we established an LNG trading desk to develop this new product line by hiring dedicated personnel. LNG traded volumes reached 1.5 million mt in 2018.

On the back of the launch of the Belgium office in 2020, we are now active in trading niche products that are tailored to the requirements of the smaller customers in the North West European market.

In 2021 we achieved the International Sustainability and Carbon Certification (ISCC) EU scheme. All our traded Biodiesel will be certified using the ISCC EU scheme.

In 2021 IEP Renewables opened an emission trading desk off the back of hiring an industry pioneer in carbon trading and already transacted over 10 million tonnes.

Acquisitions

In order to capitalize on the Group’s established setup and trading network and infrastructure, we are pursuing investment opportunities in the midstream and down- stream sectors.

We have been expanding the retail and distribution business of Hypco Turkey with a fast growing network of 111 stations. We expect to reach 126 stations throughout the county by the end of year.

In April 2018, we acquired a 70% stake in Société Pétrolière Limited (SP), which is the largest fully integrated Oil Marketing Company in Rwanda with sourcing subsidiaries in Kenya and Tanzania.

We are now looking at other downstream investment opportunities in Africa and Asia in the liquid gas space such as in Rwanda and Malaysia.

In April 2020, IEP Renewable Division (RED) Pte. Ltd. Invested in an Electric Vehicle Charging Infrastructure Investment Fund, managed by Zouk Capital, in which the UK government is the main investor.

In August 2020, we signed an agreement with a local partner to develop an LNG terminal in Italy to supply LNG to Sardinia to support the shift from coal and oil derivatives for domestic and industrial use to gas.

In October 2020, IEP Downstream invested in Euro Oil (Pvt) Ltd., an Oil Marketing Company in Pakistan selling Gasoline and Diesel from a network of retail stations in the Punjab region. Euro Oil operates 48 retail stations and one storage depot with a capacity of 7,000 mt and has plans to roll out a network of 375 retail stations and c. 50,000 mt combined storage depots in the main demand centres of the country, including Machike, Daulatpur and Taru Jabba over 5 years. IEP is the exclusive supplier of products to Euro Oil.

In addition, we opened new offices in Casablanca and reached our target to have ten operational retail stations under our brand ‘Société Pétrolière’.

In March 2021 IEP Renewables acquired Solar Century Africa, an integrated solar power developer offering development, construction, operation and fi to C&I customers (mainly mines) in Africa. This platform provides

IEP RED access to a pipeline of 2.1 GW worth of solar energy and battery storage projects across Africa.

We have recently updated our investment policy to bring it in line with the Group’s strategy to focus more on lower carbon energy trading and diversification into the renewable energy sector.

Trading Review

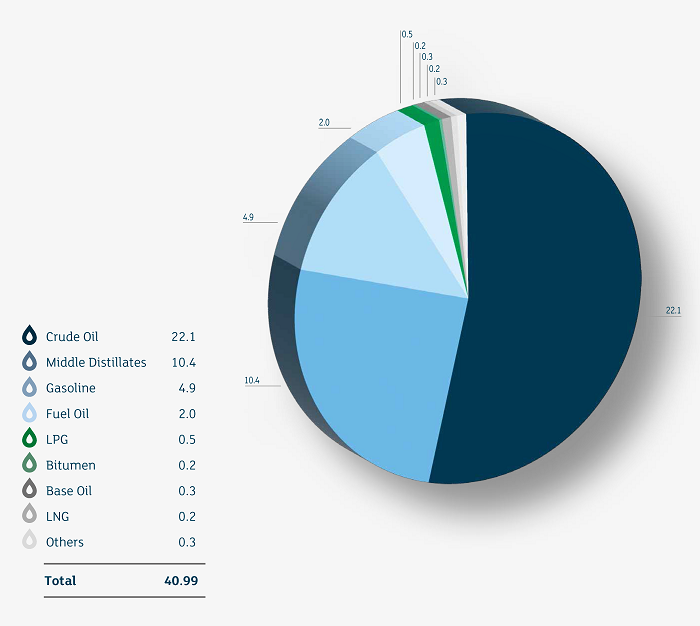

Total traded volumes in 2021 were approximately 41 million mt representing circa 105% volume growth between 2015 – 2020.

IEP’s volume of products traded during 2021 is as follows (in millions of mt):

Our core products are Crude Oil, Middle Distillates (Gasoil/ULSD and Jet Fuel) and Gasoline, followed by Fuel Oil and others.

The Group’s subsidiary Feedco S.A is one of the leading international oil traders.

Most of the remaining products are Naphta and Condensate, and small quantities of specialty products.

Crude Oil

Expansion of our Crude Oil trading activities

IEP trades a wide range of grades from different geographic regions. Crude Oil is sourced primarily from the Far East and the Middle East, as well as North Africa and with good volumes coming out of Latin America, West and East Africa.

In 2021 our Crude activity showed a continued growth with focus on new grades and new geographic regions.

The Far East and the Middle East are the main areas of destination of our Crude Oil in 2021, while maintaining a solid presence in the Mediterranean. We kept consolidating our activity in the pipeline business in the U.S.

The Crude Oil desk also continued its growth by increasing the turnaround of its storage in the U.S. In addition, trading volumes in Singapore are maintained by the blending business of Crude Oil into very low sulphur bunker Fuel Oil.

Middle Distillates

A leading player in the Middle Distillates market

The Group’s global network of Middle Distillates is made up of a wide range of products with Gasoil/ULSD representing the largest share, followed by Jet Fuel.

Apart from its core presence in the Mediterranean area and Middle East, the Group now can consider the Americas as part of its core presence due to the consistent growth achieved in the last few years.

The Group has consolidated its trading business in Europe while further growth came from South America and the Caribbean.

The Group’s arbitrage and logistical capabilities ensure consistent and timely fulfillment of the customer’s requirements.

Gasoline

Diversifying into new markets

In a very competitive environment, we maintained our market share by lever- aging on our downstream system in the Eastern Mediterranean and acted as swing suppliers for the African and Arabian Gulf markets.

The Group entered in previous years the NWE market where it has storage and blending operations and continues to expand on its presence. The Group has increased its work- force in the US to grow further in both the East and West Coast markets.

Fuel Oil

A niche player in a changing market environment

We have been one of the leading Fuel Oil traders in the Mediterranean since 1972. In more recent years, our Fuel Oil activities have been limited to a few countries still highly dependent on this product for their power generation and/or industrial needs.

Trading opportunities have since expanded through term supplies in other territories as diverse as the Americas, the Red Sea, the Arabian Gulf and the Indian subcontinent.

As we continuously work to diversify our portfolio to include lower carbon fuels, Fuel Oil traded volumes have reduced by c. 55% since 2015.

LNG and LPG

Developing liquid gas trading

LNG

IEP has developed an LNG trading desk with a dedicated team of experienced professionals and entered into a number of MSA’s with leading international and national LNG producers and suppliers.

The Group concluded its fi st LNG cargo in 2016 followed by other global deals.

We are approaching the LNG market with a strict risk management policy with the aim to gradually expand into the LNG global marketplace.

LPG

IEP started trading LPG in 2015 and is one of the leading LPG suppliers to Bangladesh, supplying Omera Petroleum Ltd. (OPL) and other domestic LPG players. OPL is a fully integrated LPG terminal, bottling, and distribution facility in Bangladesh, which the Group invested in together with a local partner and an international development institution.

OPL now sells in excess of 150,000 mt p/a of LPG and is among the top three LPG facilities in the country.

From 2019 to present, we chartered a VLGC floater in the Port of Dharma, India to supply mainly Bangladesh and surrounding countries.

Using Bangladesh as a base, we have now expanded our foothold in LPG with contracts from the US to the Pacific Islands.

Base Oil

An established player in a niche sector

In October 2016, BB Energy Trading Ltd. acquired 80% of Feedco S.A. Based in Geneva and with supporting services in Singapore, Shanghai, Manchester and in 2019 we established Feedco USA LLC in Houston. Feedco offers its customers Base Oil, Waxes, Petroleum Jellies and Pale Oils.

After three decades of activity in the Base Oil, the company reached traded volumes of 500,000 mt in 2020. This success is driven by a team with a vast experience gained in different fields such as refining shipping, distribution and blending operations.

The company has access to all major Base Oil producers, refineries and distributors on a world-wide basis which ensures it can meet all requirements for any sort of Base Oil.

As of 2022, BB Energy Trading Ltd. Has acquired the balance 20% and has full ownership of Feedco S.A.

Bitumen and Additional Products

Fast growing trader in Bitumen

Bitumen

We are a key player in the trading, transportation and distribution of Bitumen in the Mediterranean, Africa, and the Arabian Gulf. By bridging the gap between demand markets and suppliers, IEP has crucially been able to form strong partnerships with both sides. All Bitumen activities are carried out by the 3B Group.

We operate about 3 Bitumen vessels to support our trading activities.

Additional Products

We continually strive to identify opportunities and relationships that complement our core business offerings. This can typically be paraffinic Naphtha and Condensate and small quantities of specialised oil products.

Summary of Products

We trade all the components of the barrel, as well as specialised oil products and gas, to meet our clients’ needs, such as: